The beauty of batteries

Keeping the grid stable requires overbuilding generating capacity, driving up costs. Batteries fix that.

All critical infrastructure depends on buffers, inventories, and storage. Water sits in reservoirs and storage tanks; hospitals maintain blood banks and stockpiles of medicines; the financial system relies on reserves and capital buffers. All critical infrastructure, that is, with one exception.

The supply and demand of electricity must match exactly at every moment. There is no slack in the system: an electricity grid is a unique market with no inventories at all. If demand exceeds supply even briefly, the frequency of the grid drops, causing equipment to shut off and risking widespread blackouts. If supply overshoots demand, the grid becomes unstable in the other direction, forcing operators to quickly scale back production. Since electricity can’t be stored within the grid itself, the system has been built to maintain balance second by second, under all conditions.

To make this work, electricity systems rely on layers of complex rules and processes. Power plants are scheduled hours or days in advance based on forecasts. Others are paid just to stay running in case demand spikes or another plant fails. Some are required to operate even when uneconomic, in order to meet reliability rules. Prices are often fixed or averaged across large regions, so they don’t reflect real-time local conditions. These tools keep the system running, but at a high cost.

Much of the infrastructure – plants, power lines, and reserves – exists only to cover rare events and sits underused most of the time. The cost of this redundancy is passed on to consumers. This complexity also means electricity markets are less efficient than they could be. Prices and investment don’t reliably reflect scarcity, location, or flexibility. The result is an expensive, inefficient grid that is struggling to keep pace with demand and the transition to renewable energy sources.

Batteries offer a way out of this structural bind, giving producers, consumers, and distributors a way of keeping inventories for the first time ever, meaning that their value goes well beyond simply storing excess solar or wind.

They can respond in milliseconds, shift between consuming and supplying power as needed, and are controlled entirely through software. This flexibility allows them to take on a wide range of roles within the system: stabilizing frequency, supporting local distribution networks, reducing peak demand, and easing pressure on transmission lines. Because they require no fuel, emit no local pollution, and can be deployed close to where electricity is used, they can often replace several types of traditional infrastructure at once. Rather than being single-purpose assets, batteries adapt in real time to whatever role is most valuable at that moment.

The just-in-time energy supply chain

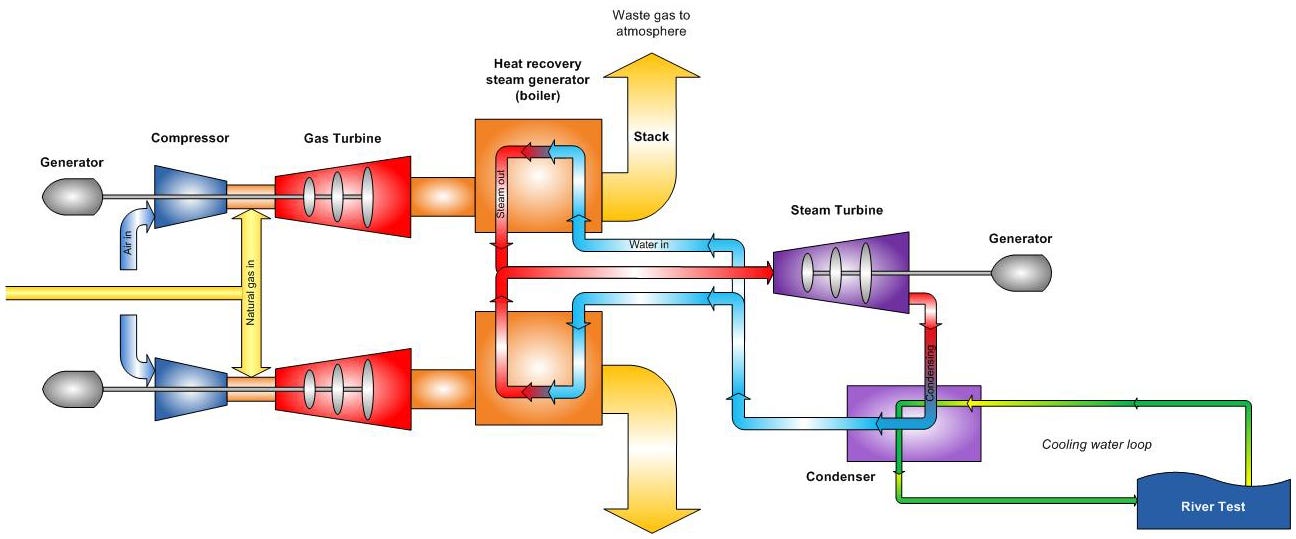

Thermal power stations, whether coal‑fired, nuclear, or combined‑cycle gas (a type of plant that uses both gas and steam turbines to improve efficiency and reduce emissions), are fundamentally large heat engines. Like any big piece of industrial equipment, they must be started up slowly. This can involve up to 20 hours of careful temperature ramp‑up to avoid cracking boilers, warping turbine rotors, or shocking reactor vessels.

Once online, they can be surprisingly brittle. In deep freezes, for example, the screens that filter debris from incoming cooling water can clog with slushy ice, restricting flow and forcing plants offline just when electricity demand spikes. At the other end of the spectrum, heat waves can shrink water supplies, raise ambient temperatures, and potentially trigger overheating and shutdown.

Even in good weather, large units are routinely pulled offline for weeks-long shutdowns to inspect and repair critical components. Technicians may need to replace corroded metal tubes that transfer heat from exhaust steam to cooling water, or to examine turbine blades for hairline cracks or deformation. These procedures are essential to prevent catastrophic failure, but they take time, specialized crews, and careful planning.

Decarbonization is adding further complexity. Utility wind and solar are already reshaping the supply curve. Renewables are expected to provide 25 percent of all US generation this year. Solar generation is set to increase by a third in 2025 alone, followed by nearly a further fifth in 2026. The resulting volatility is evident. The North American Electric Reliability Corporation, an industry body that promotes supply reliability, warned in its 2025 Summer Reliability Assessment the growing fleet of ‘intermittent renewable resources drives a risk of emergency conditions in the evening hours when solar generation ramps down and loads remain elevated’. Between January and mid-May of this year, California’s energy system operator had to curtail 2.4 terawatt hours of wind and solar output, only slightly less than total curtailment for all of 2023.

Maintaining any kind of complex process or system becomes increasingly difficult as inventory falls. Even Toyota, famous for relying on a ‘just-in-time’ model of minimal inventories, operates with some buffers and has weeks of finished goods sitting on dealer lots.

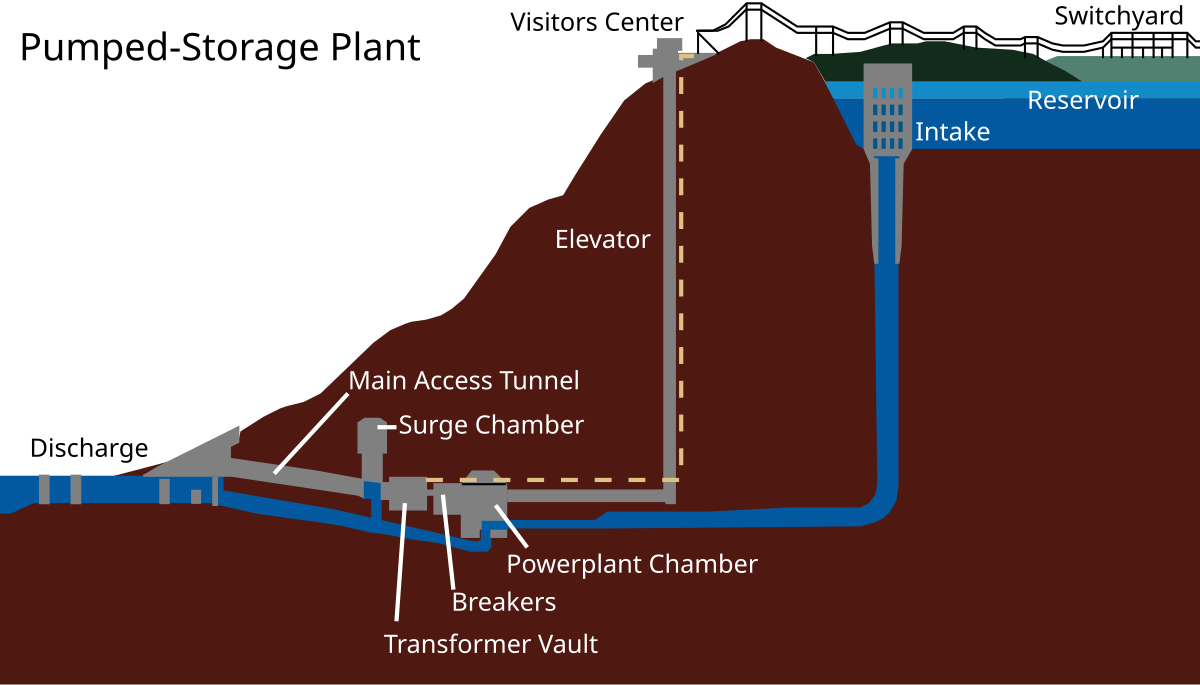

Until recently, the only substantial physical buffer in the grid was pumped-storage hydropower. It works by using surplus electricity to pump water uphill from a lower reservoir to an upper one; when electricity is needed, the water is released back down through turbines, generating power. This is efficient, scalable, and dispatchable on demand, but it’s geographically limited. Viable sites require two large reservoirs at different elevations, close enough together to manage efficiently, and with sufficient water. Even with these constraints, pumped-storage still provides 96 percent of all utility-scale energy storage in the US.

Demand-side flexibility could, in theory, compensate for rigid supply, but utilities have only minimal leverage over when customers actually consume power. Customers simply expect electricity to be available on demand. If a Toyota dealership runs out of parts, it loses sales and disappoints a handful of prospective customers, but a shortfall in the electricity supply risks cascading blackouts.

The combination of expensive storage and inflexible demand creates two problems.

First, inflexible power plants have to match demand perfectly over a wide range of conditions because there is no storage buffer and customers don’t want to change behavior.

To cover these risks, system operators must build and maintain capacity well above peak demand. The North American Electric Reliability Corporation estimates that PJM Interconnection, the largest US power grid, maintains a reserve margin of 24.7 percent. That means it has to hold roughly 125 gigawatts of generation to cover a 100 gigawatt peak. This excess capacity is mostly idle, but still needs to be financed, maintained, and staffed, pushing up system costs, which are in turn borne by billpayers. When these reserves are powered by fossil fuels, this also means higher emissions from plants running inefficiently or idling just to stay warm.

Second, it is shockingly easy to have an outage on a normal day, even with many plants on standby. If there are even slight perturbations, there may not be enough time to bring more units online, resulting in outages. This is a rough description of how the 1965 Northeast blackout, the 1977 New York City blackout, the 2003 Northeast blackout, and the 1999 Southern Brazil blackout all went.

Collapsing the cost of reliability

Electricity markets have developed some partial fixes. System operators now plan which power plants need to run a day ahead, based on demand forecasts. They also pay certain plants to stay ready on short notice or to adjust their output quickly if needed.

This has led to the emergence of a market for ancillary services, which are the grid’s insurance policy. Ancillary services are fast-acting capacity that can be brought online in under ten minutes to prevent swings in frequency and plug capacity gaps before slower acting generation comes online. In practice, this has usually involved paying for modern, fast-start gas turbines to remain on standby.

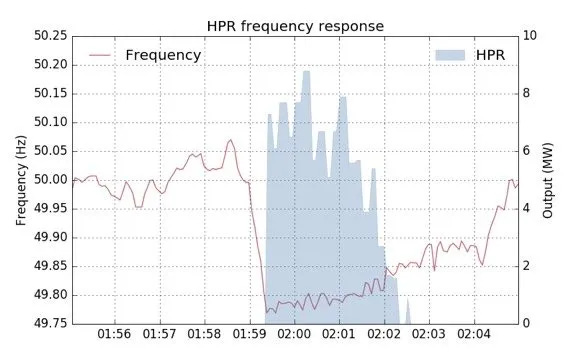

Utility-scale batteries’ millisecond response allows them to deliver frequency regulation, back up other power sources within minutes, or restart the system after an outage. In December 2017, a coal generator in Victoria, Australia tripped offline, causing 560 megawatts of generation to vanish in an instant. Hornsdale Power Reserve, a major Australian battery storage system, injected 7.3 megawatts within milliseconds to stabilize grid frequency. This bought time while slower conventional generators could ramp up, preventing an outage.

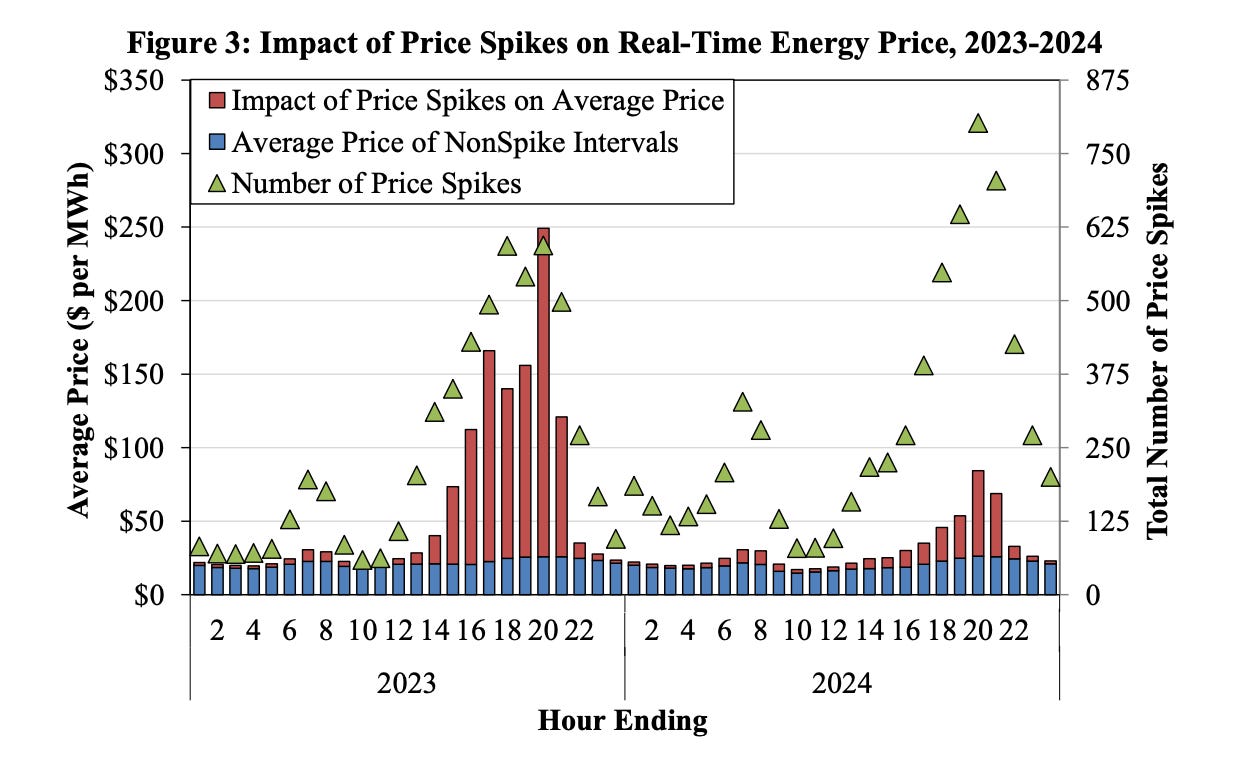

Once even a few gigawatts of storage come online, batteries quickly dominate the ancillary market and cut prices dramatically. In Texas, for example, in the space of a year, the price of ancillary services dropped from $3.74 per megawatt hour to $0.98, while the cost of maintaining the emergency reserve fell from $76.77 to $9.62 per megawatt hour. In California, ancillary service costs in 2024 were roughly one-third lower than in 2023. This is because a system with abundant fast storage no longer needs to commit gas units days in advance or pay plants to stay warm.

Ending overbuilding

As well as slashing the cost of reliability, batteries can reduce the need for surplus power plants built to cover short-lived peaks in demand. Batteries are already cheaper than new gas turbines per kilowatt, and are better suited to handling the daily rise and fall of electricity use. At 10 percent capacity factor, a gas turbine produces for $250 per megawatt hour, versus about half that for a modern battery. Their ability to charge during low-demand hours and discharge during peaks allows the rest of the system – thermal plants and renewables – to run more efficiently and predictably.

On hot days, the gap between average and peak demand is significant. On 17 July, Texas grid operator ERCOT’s total load was 1,608 gigawatt hours. That is an average of 67 gigawatts, but peak demand reached 79 gigawatts, 18 percent higher. Over the preceding 30 days, the average daily peak was 20 percent above the average load. Batteries can fill much of this gap – the ERCOT record is seven gigawatts out of 70 – reducing the need to keep additional thermal plants online just to meet brief surges.

Today’s batteries already manage daily fluctuations well. Between June and September, solar provided 25 percent of total power needs in Texas during midday hours, while batteries discharged in the evening. During this period, real-time wholesale prices averaged just $28, compared with $97 the year before. Between 6 and 9pm, when battery discharge is strongest, wholesale prices were $80 in 2024 versus $332 in 2023.

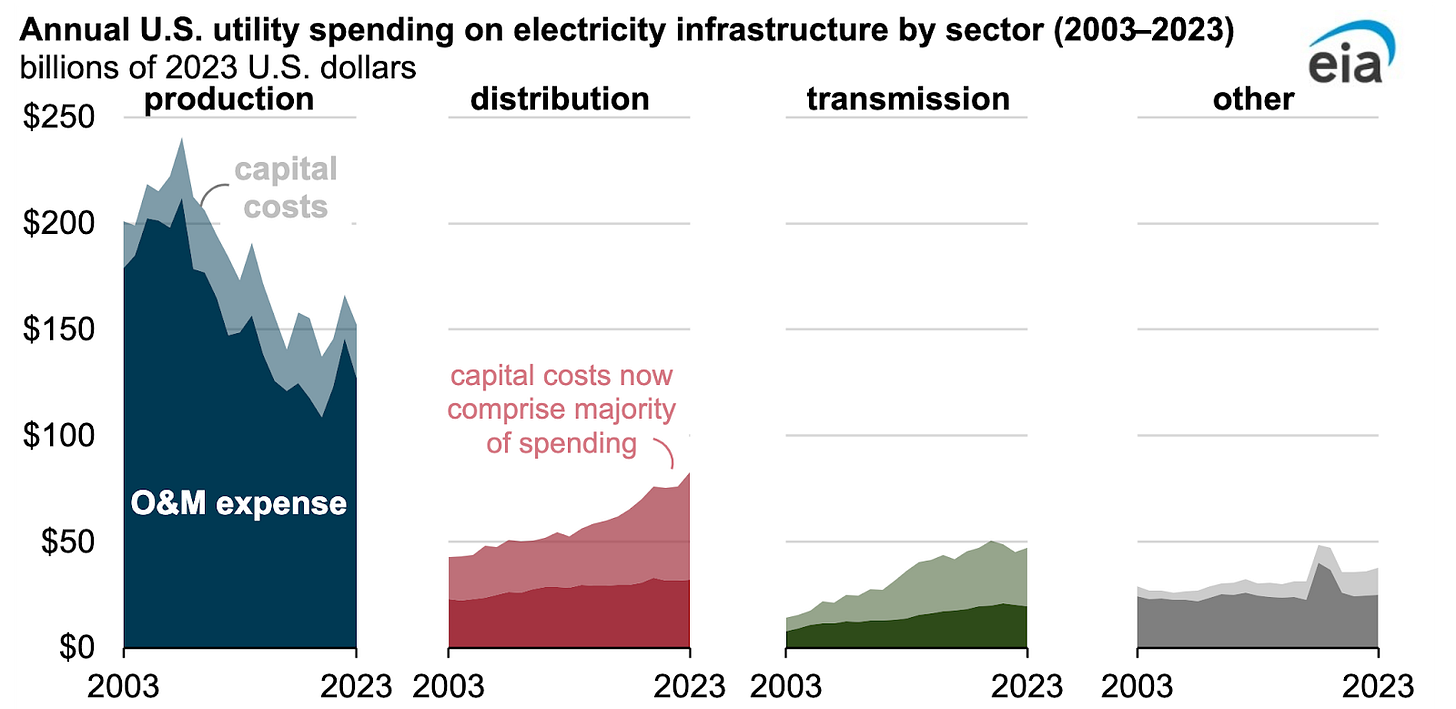

Along with overbuilding plants and reliability, another major constraint on electricity grids is inefficient and expensive power lines. In markets with locational pricing, it’s common to see large price differences between market points just 50 miles apart because of limits on how much power the lines can carry. Investment from utilities in new distribution infrastructure now significantly exceeds new investment in generation. But extra batteries are almost always cheaper than extra transmission.

Transmission and distribution lines are built to handle rare peak loads and provide redundancy in the case of outages, so they are heavily unused. Their average capacity factor is often under 50 percent, and in some cases close to 10 percent.

Batteries help solve this in two ways.

When placed on the demand side – closer to homes or businesses – they can charge during off-peak hours and discharge during peaks, letting local demand temporarily exceed what the power line could otherwise deliver. For example, a connection for a residential street that is rated for five megawatts might see six megawatts of demand on hot summer afternoons, as air conditioning systems power up. Without storage, the only solution is upgrading the wires and transformers. But installing one megawatt battery means the grid only needs to supply five megawatts, even as demand grows.

They also reduce the need for redundant circuits: a battery on a line can act as its own backup, so other lines don’t need to be oversized to cover for it. That means existing infrastructure can support much more load without upgrades. Since transmission and distribution costs are mostly fixed, spreading those costs over more delivered energy helps reduce overall system costs, and the batteries also narrow price gaps between congested parts of the grid.

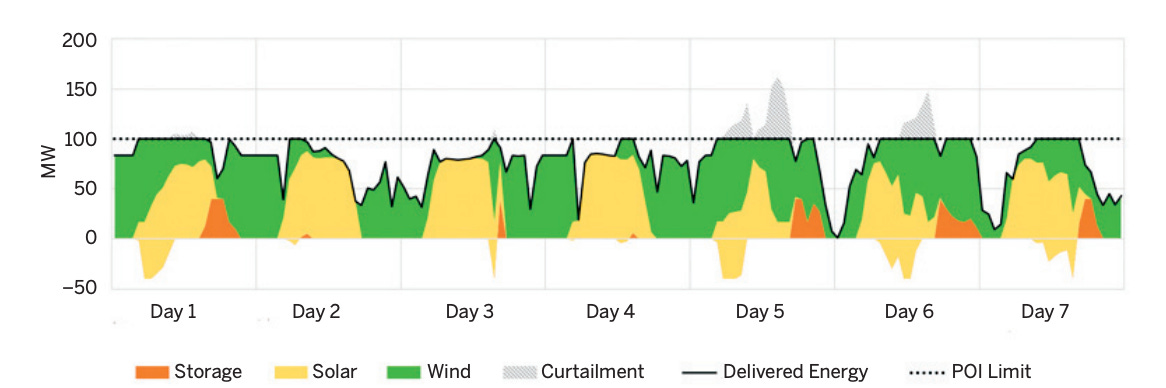

The same logic applies to power plants. The transformers, substations, and other infrastructure required to connect a solar farm to the grid can make up a third of the total project costs. A solar farm paired with a battery can operate with a cheaper, lower capacity connection. Batteries allow the plant to smooth output, store power during low-price hours, and sell more during peak times – all while avoiding the cost of a larger grid connection. This boosts revenue and lowers the average cost per unit of energy delivered.

One reason the value of batteries is often underestimated is that analysts focus only on time-based arbitrage – buying low and selling high across the day – without accounting for location-based price differences. These local price spreads can be much larger and more consistent, and batteries positioned well on the grid can take full advantage of them: storing up power when it is cheap in one area and releasing it when it is expensive there. The result is that the economic case for batteries is frequently stronger than it appears in simplified models.

The combined effect of simplifying market structures and using batteries to arbitrage both time and location is to commoditize daily electricity generation, turning time and location into cost numbers rather than complex planning operations.

Batteries and their enemies

Despite rapid growth, grid-scale batteries remain unevenly deployed, in large part because policymakers did not design regulatory systems to accommodate them. In several countries, batteries are treated as a curiosity: not quite generation, not quite demand, meaning that they are effectively banned. The Netherlands, for example, taxes residential batteries on the electricity they charge with (although grid-scale batteries can apply for an exemption), which undermines their ability to reduce price spreads. In other countries, the absence of location-based pricing prevents batteries from addressing local grid bottlenecks, even when they could do so efficiently.

The deeper issue is that many electricity markets suppress or distort price signals. These include fixed retail tariffs, uniform national pricing, price caps, and minimum generation requirements. These policies protect thermal fleets by weakening or removing the price signals that would otherwise force them out of business. Fixed tariffs and uniform pricing smooth over volatility and local congestion, shielding high-cost plants from exposure. Without strong locational and real-time prices, flexible alternatives like batteries can’t demonstrate their value, meaning the system continues to fund excessive and inflexible thermal capacity by default.

Embracing the market

A more efficient electricity system depends on embracing, not resisting, price signals and the market. Prices should vary by location, as they already do in most US wholesale markets, so that investors and operators can clearly see where supply is needed most. These signs should also be extended deeper into the distribution network, even down to the neighborhood level, so batteries can respond to local bottlenecks. This would allow the grid to adapt in real time, rather than relying on slow and expensive infrastructure upgrades.

If prices reflect real conditions across time and space, there’s less need for complex mechanisms like capacity markets or day-ahead scheduling. Real-time prices would contain the information needed to guide investment and operations. Letting those prices rise and fall naturally gives generators and storage the incentives to be available when they’re most needed.

Grid connection rules should follow the same logic. Rather than requiring every new project to wait for lengthy studies and upgrades, a more flexible ‘connect and manage’ model would let generators plug in quickly and accept the financial risk for curtailment when the grid is full. With proper locational pricing, developers can judge the risk for themselves and build where the economics make sense, not just where the permitting queue allows.

Texas offers a clear example. It already uses location-based real-time prices and has added more than ten gigawatts of batteries since 2022. Even as peak demand has grown rapidly, grid reliability has improved. Short-term price spikes now last minutes, rather than hours, and the cost of reliability services has dropped sharply.

By simply making prices reflect reality, the system can grow fast, run cheaper, and respond with greater precision. Batteries push investment into flexibility, smooth demand peaks, and keep the grid stable at lower cost. They will be the foundation of a power system that can deliver abundant electricity, with reliability built in, rather than as an afterthought.

Austin Vernon is the CEO of Standard Thermal.

Ben Southwood is a founder and editor of Works in Progress.

While I agree with you that utility-scale batteries can be very useful for load-balancing electrical supply and demand, they also drive up costs as much as over-building. Utility-scale batteries are on the order of magnitude of cost as nuclear reactors, and they do not even generate electricity.

https://frompovertytoprogress.substack.com/p/utility-scale-batteries-are-as-expensive

And most utility-scale batteries are only designed to output for 4 hours or less. They are fine for adjusting to sudden short-term fluctuations, but not for sustained output. For example, the largest utility-scale battery in the world only generates 750MW for 4 hours. That is not even enough to replace one large power station.

You are also correct that older fossil fuel-burning plants have ramp-up times around 24 hours, but this is not true of newer models. The newest Combined Cycle Natural Gas plants (CCGT) have a ramp up time of less than 30 minutes (not much slower than batteries).

https://www.gevernova.com/gas-power/products/gas-turbines/h-class-gas-turbines

In addition, CCGT can be run 24/7 for months on end, which is impossible for utility-scale batteries. If you want an affordable and stable electrical grid in North America, CCGT plants make alot more sense than utility-scale batteries.

https://frompovertytoprogress.substack.com/p/the-wonders-of-ccgt

"Even with these constraints, pumped-storage still provides 96 percent of all utility-scale energy storage in the US."

This statistic is from 2022, so it's pretty badly out of date. (The linked source in turn points here: https://www.energy.gov/sites/default/files/2023-09/U.S.%20Hydropower%20Market%20Report%202023%20Edition.pdf.)